Senior Whole Life Insurance Can Be Fun For Everyone

Table of ContentsThe Single Strategy To Use For Life Insurance OnlineThe smart Trick of American Income Life That Nobody is DiscussingExamine This Report about Whole Life Insurance Louisville9 Easy Facts About Life Insurance Online ExplainedWhole Life Insurance Louisville - The FactsChild Whole Life Insurance Fundamentals Explained

The insured event rested on the policy application. The insured omitted health and wellness problems or high-risk pastimes or activities like skydiving. Insurance coverage companies can postpone payment for 6 to year if the insured celebration passes away within the initial 2 years of the policy. Payment Options You can likewise aid make a decision exactly how your survivor benefit will certainly be paid out after you pass away.Lump-Sum Settlements Since the inception of the industry much more than 200 years ago, recipients have commonly gotten lump-sum settlements of the profits. The default payout alternative of the majority of plans remains a round figure, states Richard Reich, head of state of Intramark Insurance Solutions, Inc. Installments and also Annuities Modern life insurance plans have actually seen a monumental enhancement in exactly how payments can be supplied to the plan's recipients, says Bernstein.

These options offer the policy proprietor the possibility to choose a pre-determined, guaranteed earnings stream of in between five and 40 years. "For income-protection life insurance policy, many life insurance coverage customers favor the installment choice to guarantee the profits will last for the essential number of years," says Bernstein (Life insurance company). Recipients must bear in mind that any interest revenue they obtain goes through tax.

A Biased View of Whole Life Insurance

The insurance firm, acting as a bank or economic institution, maintains the payout in an account, permitting you to create checks against the balance. Such an account would not enable deposits yet would certainly pay passion to the recipient.

(For relevant understanding, take a better consider sped up advantage motorcyclists.) Commonly, life insurance policy plans will just pay out at the time of the insurance holder's death. Talk with your insurance policy representative regarding whether this alternative makes good sense for you. Whole life insurance Louisville. Think about speaking to an insurance coverage agent and/or estate planning lawyer regarding which payout option could function best.

Understanding just how the process functions, from buying life insurance policy to submitting a claim to receiving a payment, can help you continue with your plans to acquire coverage with confidence.

The Best Guide To Life Insurance Companies Near Me

Originally made to assist cover burial expenses and also look after widows as well as orphans, life insurance coverage is now an adaptable and also powerful financial item. Majority of Americans have some kind of life insurance policy, according to insurance study organization LIMRA (American Income Life).Life insurance policy click to investigate can be provided as either a private or team plan.

What is life insurance policy? Life insurance coverage is a contract between you as well as an insurance coverage firm.

The smart Trick of Kentucky Farm Bureau That Nobody is Discussing

If you do not die during that time, no one obtains paid. Term life is prominent due to the fact that it supplies huge payments at a lower cost than irreversible life.

You can not manage the greater premiums of long-term life insurance and also still desire coverage. American Income Life. There are some variations on normal term life insurance plans.

Rumored Buzz on American Income Life

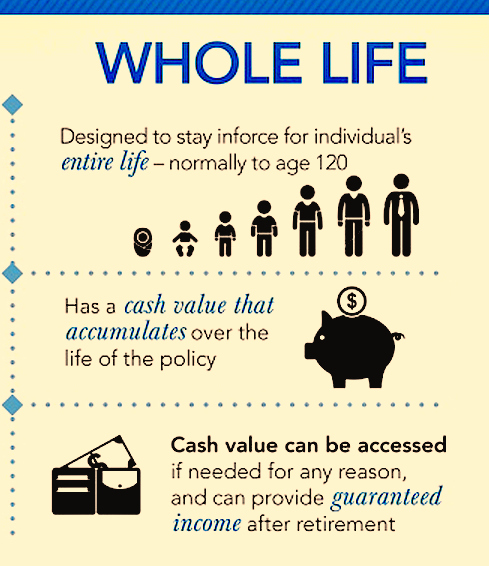

How irreversible life insurance policy functionsIrreversible life insurance coverage policies cover you up until fatality, thinking you pay your premiums. Entire life is the most well-known variation of this kind of life insurance coverage, yet there are other tastes, consisting of universal life and variable life. Permanent life insurance policy plans construct cash value as they age.

Cash worth normally climbs quickly at the start of a plan's life, when you're more youthful as well as cheaper to insure. Whole life policies boost cash money value at a set rate, while global plans fluctuate with the marketplace. It takes some time to construct the cash value in these accounts, which you need to consider when acquiring life insurance policy.

You can obtain from it, make withdrawals or simply make use of the interest repayments to cover the costs later on in life. You can also give up the policy, trading your death benefit for the value currently in the account, minus some fees. Every one of these choices can create complex tax obligation issues, so make certain you talk with a fee-based economic consultant before tapping your cash value.

The Cancer Life Insurance PDFs

Whole life premiums are a whole lot higher than term life insurance coverage premiums. That very same level of insurance coverage with a 20-year term life policy would certainly set you back a standard of about $193 every year.

Universal life plans permit you to make bigger or smaller sized settlements, depending on your funds or exactly how the investment account carries out. Indexed global life, IUL, is a kind of global life insurance that puts investments right into index funds, created by the insurance company, which attempt to track the stock market.